5 Big Retirement Investment Mistakes

Click to read this article on Forbes.com

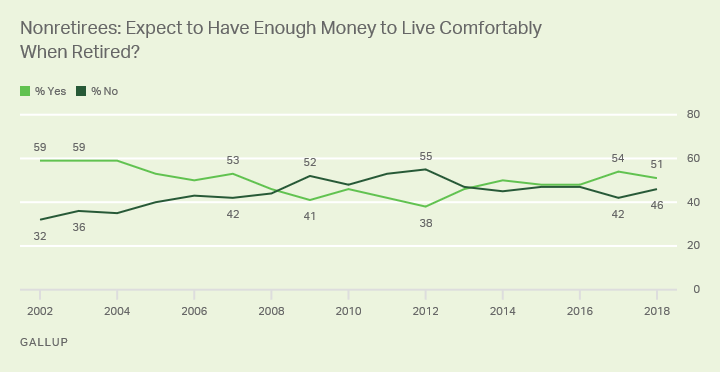

Retirement is defined as the withdrawal of one’s position or occupation or from one’s active working life. The mere mention of the word conjures up varying emotions and thoughts – everything from excitement and jubilation to fear, panic, anxiety and stress. According to a newly released report from Gallup, 46% of U.S non-retirees believe they will not have enough money in retirement (see below). For those already retired, the attitude is much more positive though with 78% reporting that they have enough money to live comfortably. Retirement for some is simply providing a comfortable existence for themselves and their spouse while for others, traveling, entertaining and leaving a financial legacy for children are all important factors contributing to an individuals’ future planning. Wherever you fall within the range of comfortable living to living life to the fullest, there are a few pitfalls and mistakes to avoid to maximize your retirement account.

- Trying to time the market

Trying to time the market just doesn’t work. With over 30 years in the financial services industry, I have repeatedly witnessed clients trying to time the market and the outcome is rarely ever favorable. The average person who tries to go in and out of the market ends up selling when it’s low and buying when the market is high. Impulsive decisions are part of human nature and often, greed and fear drive financial decisions.

- Borrowing from retirement funds

Another retirement investment mistake to avoid is to not take a loan against your 401(k). Even if sanctioned by your company, which is often a provision companies use to attract employees, it is never a good idea to borrow funds from your retirement accounts. Use other ways or find different means to pay for the things you were going to borrow against.

- Switching 401(k) funds

Similarly to timing the market, attempting to switch funds doesn’t produce the positive outcomes one would hope. Individuals who do this usually analyze how the funds performed during the year and then end up buying those funds. However, it’s inevitable that those funds could be involved in a downturn, so you end up buying last year’s performance. It is important to remember that past performance does not guarantee future performance. What seems like a wise decision on paper ends up costing you. Set up an allocation as part of your retirement plan and stay the course.

- Being Impatient

Warren Buffet said, “the stock market is where impatient people transfer money to patient people.” Wise words and very truthful. Patience is one of the biggest assets contributing to positive investment strategies. Focusing on short-term results can be detrimental to the long-term goals of your portfolio. Remain patient!

- No real plan

One of the single most important pieces of advice that any financial advisor or business professional should give a client is to develop a well thought out retirement plan. One that considers factors like future lifestyle choices, income components which include savings, social security, retirement accounts and any debt you may incur, long-term health care costs, inflation and caring for those left behind. Plans can be modified but they provide the framework for future decision making. Therefore, actions are decided based on solid fact-finding analysis rather than based on emotion and fear.

Certainly, retirement means different things to different people as does retirement planning. Some have well thought out retirement plans which cover every component and every life situation while others’ plans are very short and just cover the basics. Regardless of the type of retirement plan, it is important to avoid the mistakes mentioned above. Retirement planning is not an exact science but making smart decisions and not being emotionally reactive are essential considerations in building a financially secure retirement portfolio.

Related: Money Wisdom Podcast “The 5 Crippling Penalties That Can Blindside You In Retirement”

Information presented in our podcasts is considered current as of the created date. Over time, some information presented may become stale. We recommend you consult with your Financial Professional before making any changes based on information contained here.

Johnson Brunetti is a marketing name for the businesses of JB Capital and JN Financial.

Investment Advisory Services offered through JB Capital, LLC. Insurance Products offered through JN Financial, LLC.

The guarantees provided by any type of insurance contract are based on the claims-paying ability of the insurance company.

Related Resources

-

Are You Paying Too Much in Taxes in Retirement?

You’ve worked hard to build your retirement savings, but have you thought about how much of it you’ll get to keep after taxes? Unfortunately, many retirees pay more in taxes than they expected sim… -

Can I Retire Early?

If you’re considering retiring early, there are a few things you need to cross off your list before setting sail into your retirement years. For many people, one of the first things that comes to … -

Magic Retirement Number

Do you know your magic retirement number? This is the amount of money you need to retire – and it’s different for everyone. Let’s explore how to calculate your number, how it compares to the rest … -

Johnson Brunetti Named in 2024 Best Places to Work in Connecticut

On March 7th 2024, Johnson Brunetti was named #1 in the Small/Medium Employer Category of the Best Places to Work in Connecticut. This annual program was created by the “Hartford Business Jour… -

Financial Planning & Holiday Traditions

The holiday season is here. It’s a time for family and traditions, but it’s also a time where you can take some opportunity to talk or think about some of the important financial components that c… -

Long-Term Care Awareness Month

November marks Long-Term Care Awareness Month, a time to raise awareness and understanding about long-term care. We also celebrate Thanksgiving this month – a time for gathering with loved ones an… -

October is Financial Planning Month

Obviously there’s a need for financial planning if somebody named October to be Financial Planning Month. There’s a need for people to be aware of the importance of financial planning. There are s… -

Healthy Aging

What is healthy aging? As a financial planner, I think a lot of people assume I’m going to go right into the money part of financial planning or the money part of aging; I’m not going to do that. … -

Financial Planning for Grandkids

Let’s discuss some of the wisdom that grandparents can impart to grandkids; as we all know, when those grandkids get to a certain age, they’re not listening to their parents anymore, but they sure… -

Financial Independence

Financial independence is the ability to do what I want, when I want to do it, and enjoy the people I love and the things that I care about. What we really want is to have enough money to do that….