Episode 15: Should I Buy Long-Term Care Insurance?

Have your question answered on the Money Wisdom Question Series!

Thank you for joining us for Episode 15 of our Money Wisdom Question Series, where we film answers to common financial and retirement investment questions. Today’s question is “Should I buy long-term care insurance?” It’s a big subject that always comes up and people have a lot of concerns about it.

What is Long-Term Care Insurance?

Long-term care insurance covers you if you need care in your home or in a nursing home. Specifically, it includes a variety of services aimed at helping individuals accomplish the Activities of Daily Living (ADLs). There are varying levels of long-term care dependent upon each person’s assistance level needed.

The Cost of Long-Term Care Insurance

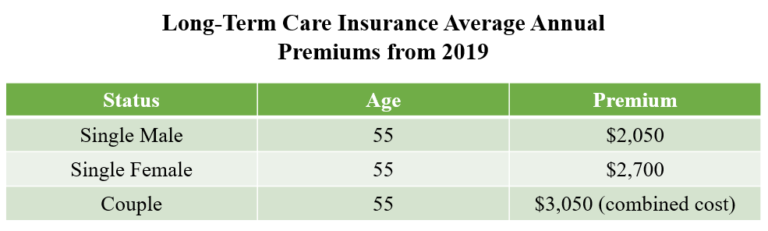

The cost of long-term care insurance does continue to get more expensive and very often, people do say this is a big factor for them. Below is the 2019 Price Index for the average annual premium long-term care insurance. (statistics provided by the American Association for Long-Term Care Insurance)

People will say, “I don’t want to pay insurance for a nursing home.”, but that’s not the reason for purchasing it. It’s to protect your money so that you don’t spend everything on care. If you pass away and didn’t purchase long-term care insurance and ended up having all those medical costs, now there’s no money left for a widow, family, or any other reason that you were saving that money for. It’s expensive because what it insures is very expensive.

What is Your Plan for Long-Term Care?

You don’t necessarily need to buy long-term care insurance, but you do need to have a conversation about what your plan is if you or your spouse gets sick. Your plan could be long-term care insurance. It could be looking at an estate plan or shifting assets out of your name. There are pros and cons to each one of these scenarios. When you look at long-term care insurance, it is a product specifically designed to pay for that need.

Unfortunately, many of us have had grandparents that have been in healthcare facilities. We have had clients that have been in care facilities paying hundreds of thousands of dollars a year. It also depends on the state that you’re living in. For example, here in Connecticut, there is a very high cost of care. You can receive really good care, but it’s expensive.

Don’t Delay

I wouldn’t delay this conversation any longer. Like anything, get a number of different opinions on it. If someone is saying you really need to buy the insurance, think about what is best for you before making that big financial commitment. There are really great options available to you, but make sure to get multiple inputs on them. The most important thing is to have a plan.

Thanks for joining me and I hope you found this information helpful! If you enjoyed this topic and you want to hear more, you’ll love this Forbes article where Joel talks more about long-term care insurance.

P.P.S. Feel free to submit questions here for a chance to have them answered!

Download Now

Estate Planning Checklist

Estate planning is a large component of retirement planning, ensuring your assets are distributed according to your final wishes. Creating an estate plan allows greater control, privacy and security of your legacy.

Information presented here is considered current as of the created date. Over time, some information presented may become stale. We recommend you consult with your Financial Professional before making any changes based on information contained here.

Johnson Brunetti is a marketing name for the businesses of JB Capital and JN Financial.

Investment Advisory Services offered through JB Capital, LLC. Insurance Products offered through JN Financial, LLC.

The guarantees provided by any type of insurance contract are based on the claims-paying ability of the insurance company.

Related Resources

-

What’s the Biggest Challenge Retirees Will Face?

Over the next decade, retirees will face many challenges, but the biggest one may not be financial. While markets, inflation, healthcare, and taxes are all important, Joel Johnson, CFP® highlights… -

How Is Medicare Changing in 2026?

Medicare costs like premiums, deductibles, and copays generally change every year. But what does this mean for your broader retirement plan? Well, even small adjustments can have a large impa… -

What Financial Resolutions Should I Make This Year?

What financial resolutions will you ring in the new year with? According to Vanguard’s new consumer survey, most Americans feel confident in achieving their 2026 financial resolutions. While that’… -

What Important Financial Wisdom Have You Learned?

Your behavior around money can either be your greatest obstacle or your greatest strength. Often, an investor’s behavior is the biggest impediment to their success. With over 30 years of experi… -

What Should I Do If I’m Laid Off Right Before Retirement?

A layoff close to retirement can rock your sense of financial stability, but it doesn’t have to derail your plans. Job losses often lead many people to take an earlier-than-expected retirement. Bu… -

Should I Retire in 2026?

Deciding to retire at any time depends more on your personal financial readiness than on the calendar year itself. But while there is no one-size-fits-all answer, there are certain indicators to t… -

Should I Rebalance My Portfolio Before the New Year?

Does rebalancing belong on your year-end to-do list? Reviewing your asset mix before the new year can help ensure your portfolio still reflects your goals and risk tolerance. But while rebalancing… -

What Is the Best Way to Pay for Long-Term Care?

What’s the “best” way to pay for long-term care expenses? The answer is highly personal, depending on your unique financial situation and individual needs. Regardless of your stage in life, it’s i… -

The 3-Bucket Strategy for Retirement

When saving for retirement, many mistakes stem from how people view their investments. Each portion of your money should have a specific purpose. Without these distinctions, you may be more prone … -

Should I Pay Off Debt Before Investing?

Whether you’re in or approaching retirement, having extra cash lying around can pose a real dilemma. Should you invest it for potential future growth, or use it to pay down significant debt? Both …

-

Laura H.Laura H. is a client of Johnson Brunetti and received no compensation for their statement.

“Your corporate values and mission have stayed constant which we’d say is the primary reason we are so satisfied. We believe that mission should never change.”

Testimonials received in response to Johnson Brunetti survey conducted in 2024. Please click here for a description of the survey and the overall results.

-

John L.John L. is a client of Johnson Brunetti and received no compensation for his statement.

“We are extremely please with J&B. Referring back to our one word, Family, we trust your firm, advisors, and services as we would a member of the Family. Thank you for everything!”

Testimonials received in response to Johnson Brunetti survey conducted in 2024. Please click here for a description of the survey and the overall results.

-

Joe D.Joe D. is a client of Johnson Brunetti and received no compensation for his statement.

“Your model is working well, continue to keep your focus on your clients. The podcasts are an effective way of communicating information and real life stories. Your business is supporting your clients’ many different real life stories.”

Testimonials received in response to Johnson Brunetti survey conducted in 2024. Please click here for a description of the survey and the overall results.

-

Jackie L.Jackie L. is a client of Johnson Brunetti and received no compensation for her statement.

“I love how everyone in the company makes us feel. Like we are one big happy family. I wouldn’t change anything! “

Testimonials received in response to Johnson Brunetti survey conducted in 2024. Please click here for a description of the survey and the overall results.

-

Christine Q.Christine Q. is a client of Johnson Brunetti and received no compensation for her statement.

“Your services are exemplary and greatly appreciated by my husband and myself to live out our retirement years feeling safe and secure. Thank you!”

Testimonials received in response to Johnson Brunetti survey conducted in 2024. Please click here for a description of the survey and the overall results.

-

Barbara S.Barbara S. is a client of Johnson Brunetti and received no compensation for her statement.

“We are very happy with Johnson Brunetti. It has really taken a load off our shoulders. Thank you.”

Testimonials received in response to Johnson Brunetti survey conducted in 2024. Please click here for a description of the survey and the overall results.