7 Ways to Throw the Best Retirement Party

At Johnson Brunetti, we spend a lot of time talking about the financial side of retirement. Today, we are going to break up the monotony with a little bit of fun! Retirement is a rite of passage towards the next chapter of our lives. Consequently, it can be bittersweet. Some people are sad to say goodbye to their favorite colleagues. Others are excited to relocate to a warmer climate, or closer to family. Whether you’re getting ready for retirement, or if it’s for someone in your family, company or circle of friends, a retirement party is a special way to celebrate. We have a few suggestions for retirement party ideas to make it memorable, without breaking the bank.

Please keep in mind that these are only suggestions to help you throw a great party! This article is not a paid advertisement and none of the mentioned businesses are affiliated with JB Capital, LLC in any way. We encourage you to exercise all necessary safety and security precautions.

1. Create the Retirement Party Guest List

Consider any current colleagues, close family members, and friends. If it’s not a surprise party, it might be a good idea to talk to the honoree, therefore ensuring that all their closest colleagues are invited. This will help remove the guesswork. Keep in mind that this event can be a team effort. Don’t shy away from asking for help from a few different colleagues and friends who may be able to help you divide and conquer.

2. Research Venues

Once the guest list is created, it’s time to select a date and venue that suits your party size. Remember to be considerate when choosing a date. Weeknights can make it difficult for some people to attend. Likewise, try not to host the party during a holiday weekend when people might be traveling to be with family.

If the office is not an option, there are several creative options for venues besides a restaurant or banquet hall. You can host a backyard barbecue or pool party. You can also spend some time searching for unique and affordable venues in your town or state on websites like this. Bonus points if you’re able to tie the venue into the party’s theme!

3. Choose an Appropriate Theme for the Retirement Party

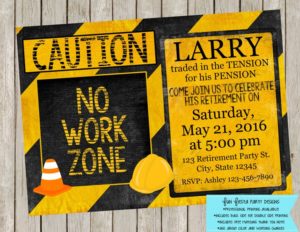

The most original themes help tell a story of the honoree – covering everything from their past, present, and future. For example, if the guest of honor worked in construction, you may want to incorporate hammers and hardhats. You can also use a favorite sports team or hobby as a theme. On the other hand, if they have a trip to Hawaii on the horizon, go for a luau theme. There are lots of ways to tie it into their personal life and make the details of the party special. Don’t be afraid to think outside of the box!

4. Make the Invitations

When the guest list, venue, and theme are all set, it’s time to work on invitations! If you’re looking to order something that you can customize yourself, start your research here. If you prefer something a little less do-it-yourself (DIY) that can still match your theme, try looking here. Be sure to address the invitation to your guests and inform them of whether or not they can bring a spouse or significant other. This article should help you communicate the most important event details.

5. Browse Personalized Gifts, Party Favors, and Decorations

If you aren’t opposed to shopping online, Etsy can be a fantastic resource to anyone looking to plan a party. You can find just about anything to fit your theme. Most importantly, many items can be personalized. From hats and funny t-shirts to engraved wooden signs, to these adorable retire-mints, and other creative party favors and accessories. In other words, there’s something for nearly every budget.

Please keep in mind, as with any online shopping, it’s important to be your own advocate. On Etsy, it’s really important and helpful to read the descriptions, shipping options and review all the photos. Keep in mind that each seller will have different store ratings, turnaround times, pricing and terms for doing business – make sure they are highly rated and come with positive transaction reviews.

Don’t go it alone if you’re not comfortable! Chances are, you have a friend or family member who has used Etsy before and can help you.

6. Consider Do-it-Yourself (DIY) Options

For those of you who love a good DIY project, Pinterest has great ideas for budget-friendly and inventive retirement party decorations, games

7. Make it Sweet

Sweeten the deal with a creative dessert that goes with the theme. If it’s a bigger party, try cake pops or cupcakes. This will remove the hassle of having to cut and distribute dessert.

Be sure to ask someone to say a few words about the honoree before dessert. Maybe even consider collecting photos and videos from friends, family, and colleagues to create a slideshow. You can either use a projector set, or cast the slideshow from a laptop onto a TV screen at your venue.

… And Most of All, Have Fun!

The most important part of the party is enjoying it! Even if you go minimal on the decorations and flair, it’s all about honoring the new retiree and making sure they have a great time.

Information presented here is considered current as of the created date. Over time, some information presented may become stale. We recommend you consult with your Financial Professional before making any changes based on information contained here.

Johnson Brunetti is a marketing name for the businesses of JB Capital and JN Financial.

Investment Advisory Services offered through JB Capital, LLC. Insurance Products offered through JN Financial, LLC.

The guarantees provided by any type of insurance contract are based on the claims-paying ability of the insurance company.

Related Resources

-

Podcast Episode 438: What 59% of Retirees Wish They’d Known About Taxes

Prefer to watch? Click here to watch and listen on YouTube. According to a recent Nationwide Retirement Institute survey, 59% of retirees regret not preparing for taxes. More specifically, how … -

What is the Financial Impact of Retiring at 62 vs 65?

Retiring at any age requires thoughtful, tailored planning. But when faced with the choice to take an early retirement or continue working, the right answer depends on several personal factors. … -

Podcast Episode 436: How Has Retirement Changed in the Past 10 Years?

Prefer to watch? Click here to watch and listen on YouTube. How has retirement changed over the last decade, and why does it matter now? If you’re planning for retirement the same way people di… -

What’s the Biggest Challenge Retirees Will Face?

Over the next decade, retirees will face many challenges, but the biggest one may not be financial. While markets, inflation, healthcare, and taxes are all important, Joel Johnson, CFP® highlights… -

How Is Medicare Changing in 2026?

Medicare costs like premiums, deductibles, and copays generally change every year. But what does this mean for your broader retirement plan? Well, even small adjustments can have a large impa… -

Podcast Episode 434: I’m 59½, What Should I Do with My 401(k)?

Prefer to watch? Click here to watch and listen. If you’re approaching age 59½, you’ve hit an important financial milestone. New options are now available, and you may not realize just how many… -

What Important Financial Wisdom Have You Learned?

Your behavior around money can either be your greatest obstacle or your greatest strength. Often, an investor’s behavior is the biggest impediment to their success. With over 30 years of experi… -

Podcast Episode 433: 5 Must-Know Social Security Rules Before You File

Prefer to watch? Click here to watch and listen on YouTube. Timing your Social Security retirement benefits isn’t simply choosing an age and calling it a day. This is one of the biggest financi… -

Podcast Episode 432: 10+ Retirement Bucket List Ideas

Prefer to watch? Click here to watch and listen on YouTube. Retirement is ultimately about finding purpose and community. Yet many retirees discover that even with enough savings, it can be dif… -

Podcast Episode 431: Am I Holding Too Much Cash in Retirement?

Prefer to watch? Click here to watch and listen on YouTube. What does it mean to be financially “safe” once you retire and your paycheck stops? If you’re wondering whether too much cash could p…

-

Laura H.Laura H. is a client of Johnson Brunetti and received no compensation for their statement.

“Your corporate values and mission have stayed constant which we’d say is the primary reason we are so satisfied. We believe that mission should never change.”

Testimonials received in response to Johnson Brunetti survey conducted in 2024. Please click here for a description of the survey and the overall results.

-

John L.John L. is a client of Johnson Brunetti and received no compensation for his statement.

“We are extremely please with J&B. Referring back to our one word, Family, we trust your firm, advisors, and services as we would a member of the Family. Thank you for everything!”

Testimonials received in response to Johnson Brunetti survey conducted in 2024. Please click here for a description of the survey and the overall results.

-

Joe D.Joe D. is a client of Johnson Brunetti and received no compensation for his statement.

“Your model is working well, continue to keep your focus on your clients. The podcasts are an effective way of communicating information and real life stories. Your business is supporting your clients’ many different real life stories.”

Testimonials received in response to Johnson Brunetti survey conducted in 2024. Please click here for a description of the survey and the overall results.

-

Jackie L.Jackie L. is a client of Johnson Brunetti and received no compensation for her statement.

“I love how everyone in the company makes us feel. Like we are one big happy family. I wouldn’t change anything! “

Testimonials received in response to Johnson Brunetti survey conducted in 2024. Please click here for a description of the survey and the overall results.

-

Christine Q.Christine Q. is a client of Johnson Brunetti and received no compensation for her statement.

“Your services are exemplary and greatly appreciated by my husband and myself to live out our retirement years feeling safe and secure. Thank you!”

Testimonials received in response to Johnson Brunetti survey conducted in 2024. Please click here for a description of the survey and the overall results.

-

Barbara S.Barbara S. is a client of Johnson Brunetti and received no compensation for her statement.

“We are very happy with Johnson Brunetti. It has really taken a load off our shoulders. Thank you.”

Testimonials received in response to Johnson Brunetti survey conducted in 2024. Please click here for a description of the survey and the overall results.