Episode 15: Should I Buy Long-Term Care Insurance?

Have your question answered on the Money Wisdom Question Series!

Thank you for joining us for Episode 15 of our Money Wisdom Question Series, where we film answers to common financial and retirement investment questions. Today’s question is “Should I buy long-term care insurance?” It’s a big subject that always comes up and people have a lot of concerns about it.

What is Long-Term Care Insurance?

Long-term care insurance covers you if you need care in your home or in a nursing home. Specifically, it includes a variety of services aimed at helping individuals accomplish the Activities of Daily Living (ADLs). There are varying levels of long-term care dependent upon each person’s assistance level needed.

The Cost of Long-Term Care Insurance

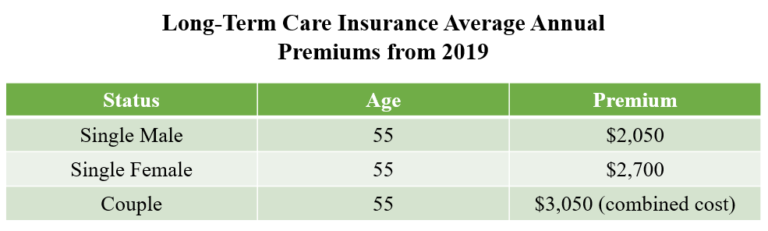

The cost of long-term care insurance does continue to get more expensive and very often, people do say this is a big factor for them. Below is the 2019 Price Index for the average annual premium long-term care insurance. (statistics provided by the American Association for Long-Term Care Insurance)

People will say, “I don’t want to pay insurance for a nursing home.”, but that’s not the reason for purchasing it. It’s to protect your money so that you don’t spend everything on care. If you pass away and didn’t purchase long-term care insurance and ended up having all those medical costs, now there’s no money left for a widow, family, or any other reason that you were saving that money for. It’s expensive because what it insures is very expensive.

What is Your Plan for Long-Term Care?

You don’t necessarily need to buy long-term care insurance, but you do need to have a conversation about what your plan is if you or your spouse gets sick. Your plan could be long-term care insurance. It could be looking at an estate plan or shifting assets out of your name. There are pros and cons to each one of these scenarios. When you look at long-term care insurance, it is a product specifically designed to pay for that need.

Unfortunately, many of us have had grandparents that have been in healthcare facilities. We have had clients that have been in care facilities paying hundreds of thousands of dollars a year. It also depends on the state that you’re living in. For example, here in Connecticut, there is a very high cost of care. You can receive really good care, but it’s expensive.

Don’t Delay

I wouldn’t delay this conversation any longer. Like anything, get a number of different opinions on it. If someone is saying you really need to buy the insurance, think about what is best for you before making that big financial commitment. There are really great options available to you, but make sure to get multiple inputs on them. The most important thing is to have a plan.

Thanks for joining me and I hope you found this information helpful! If you enjoyed this topic and you want to hear more, you’ll love this Forbes article where Joel talks more about long-term care insurance.

P.P.S. Feel free to submit questions here for a chance to have them answered!

Download Now

Estate Planning Checklist

Estate planning is a large component of retirement planning, ensuring your assets are distributed according to your final wishes. Creating an estate plan allows greater control, privacy and security of your legacy.

Information presented in our podcasts is considered current as of the created date. Over time, some information presented may become stale. We recommend you consult with your Financial Professional before making any changes based on information contained here.

Johnson Brunetti is a marketing name for the businesses of JB Capital and JN Financial.

Investment Advisory Services offered through JB Capital, LLC. Insurance Products offered through JN Financial, LLC.

The guarantees provided by any type of insurance contract are based on the claims-paying ability of the insurance company.

Related Resources

-

What’s the Best Age to Start Taking RMDs?

Is it better to take your required minimum distribution (RMD) sooner rather than later? While the IRS determines when you must begin taking RMDs, you may benefit from taking them earlier. An RM… -

Should I Downsize My Home for Retirement?

Equity is on the minds of many pre-retirees and retirees today, more specifically: Should I downsize my home in retirement? And if so, when is the right time to do it? In this week’s Money Wisd… -

How Can You Protect Your Retirement Assets for Your Family?

When you’re focused on planning for retirement, it’s easy to overlook how you can protect your assets for both yourself and your family. While there’s no one-size-fits-all approach, your first ste… -

What Level of Risk Is Right for Your Retirement Plan?

In this week’s Money Wisdom Question Series, Ian Fergusson, RICP® addresses a fundamental concern for anyone approaching or in retirement: What level of risk is appropriate for my retirement plan?… -

What Estate Planning Steps Should I Take?

With retirement on the horizon, you may be wondering what steps you should be taking from an estate planning standpoint. At its core, there are three key estate planning considerations to keep in … -

How Can I Protect My Retirement Savings from Market Volatility?

We’ve been receiving a lot of questions lately about how to best protect your retirement savings against stock market volatility. It’s easy to let recent fluctuations in the market shake your conf… -

What Should I Watch Out for When Reviewing My Retirement Tax Return?

Now that tax season is over and your return is filed, you may be wondering what you need to review in preparation for next year, especially if you’re approaching retirement. In this week’s Mone… -

How Do Tariffs Affect the Stock Market?

If you’ve been tuned into the news lately, you’ve probably heard a lot about tariffs. The current administration’s latest economic push has introduced a wave of uncertainty in the market. But what… -

How Do I Get Out of Debt Fast?

Most people with debt want to get out of it quickly and efficiently. To do that, you first need a clear understanding of your financial situation. Second, you need a clear, actionable plan. In … -

Why Do I Need to Account for Inflation in Retirement?

Today’s question is: What is inflation and why is it important to account for in my retirement plan? Inflation is the rising cost of goods over time. Meaning, it will cost you more money next year…