What’s the Right Medicare Plan for Me?

Have your question answered on the Money Wisdom Question Series!

There is a lot to consider when choosing the right Medicare plan: How often do you visit the doctor? Do you have any chronic conditions? Do you take prescription drugs regularly? Answering these questions can help you pinpoint the type of coverage you need.

In this week’s Money Wisdom Question Series, join Jake Doser, CFP®, CPWA® as he goes deeper into demystifying key Medicare decisions, starting with the differences between Parts A, B, C, and D.

Parts A & B: Original Medicare

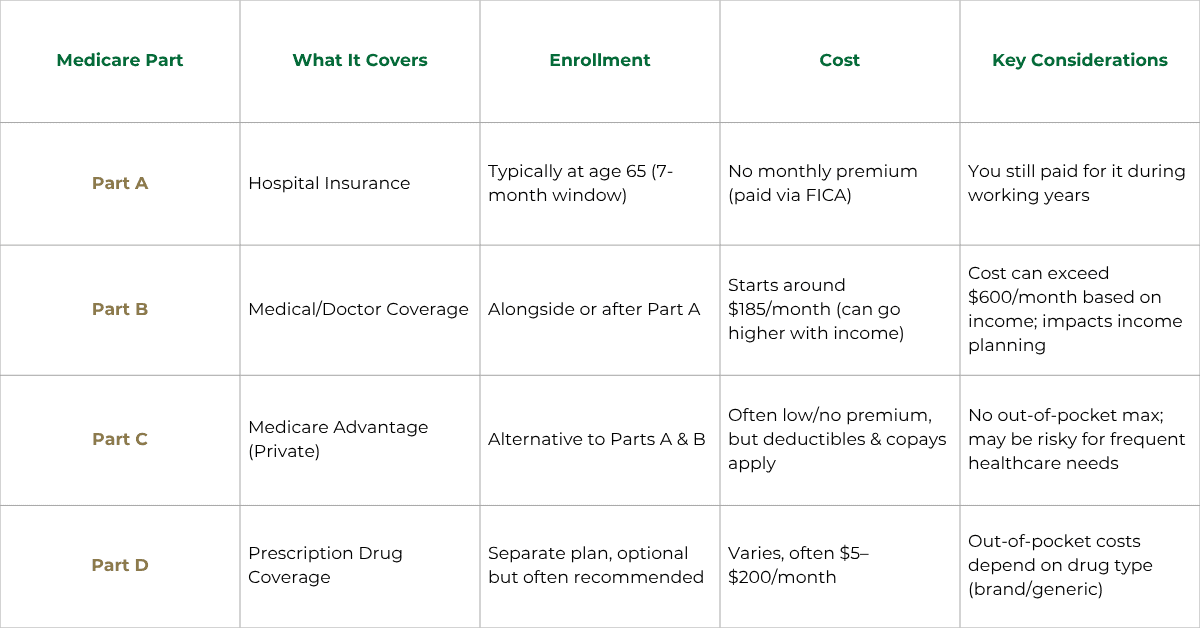

Medicare Part A is the initial coverage most people enroll in when they turn 65. You have a seven-month Initial Enrollment Period (IEP) that begins three months before your 65th birthday, includes the month you turn 65, and continues for three months afterward. While there is technically no monthly premium for Part A, you’ve been paying for this coverage throughout your working years via FICA taxes.

Next is Medicare Part B, which, when combined with Part A, is referred to as Original Medicare. Unlike Part A, Part B requires a monthly premium, currently starting at $185 per month. However, if your income exceeds certain thresholds, this premium can increase significantly. That’s why it’s important to include Medicare costs in your overall income planning strategy.

Part C: Medicare Advantage

You also have the option to sign up for Medicare Part C, instead of Parts A & B. Known as Medicare Advantage, these plans often have little to no monthly premium, but they usually include deductibles and copayments.

Additionally, many Medicare Advantage plans do not have a cap on out-of-pocket expenses, so costs can add up quickly. If you have frequent doctor visits or upcoming surgeries, this may not be the best option for you.

Part D: Prescription Drug Coverage

Finally, Medicare Part D is available for prescription drug coverage. Costs for Part D often range from $5 to $200 per month, depending on the medications you need and whether they are brand name or generic. You may also have out-of-pocket expenses based on your prescriptions.

Discuss Your Options with an Agent

It’s important to carefully consider which Medicare plan makes the most financial sense within the context of your overall retirement plan. Working with an independent Medicare agent who understands your options and can provide unbiased advice is crucial. Independent agents have access to a wider range of plans and can help you find the best fit for your needs.

Download Now

10-Point Retirement Checklist

Here’s a checklist of our most important things you can do, to help you retire strong.

Information presented here is considered current as of the created date. Over time, some information presented may become stale. We recommend you consult with your Financial Professional before making any changes based on information contained here.

Johnson Brunetti is a marketing name for the businesses of JB Capital and JN Financial.

Investment Advisory Services offered through JB Capital, LLC. Insurance Products offered through JN Financial, LLC.

The guarantees provided by any type of insurance contract are based on the claims-paying ability of the insurance company.

Related Resources

-

When Is the Right Time to Buy Long-Term Care Insurance?

Nearly half of applicants over age 70 are unable to qualify for traditional long-term care insurance. This is just one of the many reasons to consider purchasing an insurance policy as early as po… -

How Much Can I Contribute to an IRA?

Are you contributing the maximum amount to your individual retirement account, or IRA? Many people aren’t taking full advantage of their contribution limits. That could mean missing out on valuabl… -

Should I Use a Health Savings Account (HSA) in Retirement?

A health savings account (HSA) can be a tax-advantaged way to save for qualified medical expenses. While HSAs play an important role in financial planning, are they worth using in retirement? I… -

What Should I Do If I Win the Lottery?

Winning the lottery, never working again, and having all your hopes and desires come true — for most people, that’s only a dream. But in the happenstance that you do hit the jackpot, what should y… -

4-Point Retirement Income Planning Checklist

Income is everything in retirement, and that realization can feel overwhelming. Even if you feel prepared, it’s still important to ensure you’re getting the most out of your money. By taking small… -

Who Should Consider a Roth Conversion?

Converting pre-tax funds into a Roth account can potentially reduce your tax burden in retirement. Roth IRAs offer unique benefits that differ from traditional tax-deferred accounts. While you … -

Healthcare in Retirement: Frequently Asked Questions

As you get closer to your retirement years, healthcare becomes a more pressing financial concern. How will you pay for coverage no longer provided by your employer? Which health insurance plan bes… -

What Are Essential Financial Steps for the Last Quarter?

If you can believe it, we’re entering the last quarter of the year. Time sure did fly by, but before 2025 officially ends, there are still a few financial matters to address. In this week’s Mon… -

What Is the Best Age to Claim Social Security?

It can be hard not to play the comparison game when making major decisions in retirement. One of which is when to collect Social Security benefits. Your friend may have claimed early at age 62, bu… -

3 Habits of Successful Retirees

We’re creatures of habit, and our financial behaviors are no exception. Specifically in retirement, your financial decisions can either hold you back or help you achieve long-term success. So, whi…

-

Laura H.Laura H. is a client of Johnson Brunetti and received no compensation for their statement.

“Your corporate values and mission have stayed constant which we’d say is the primary reason we are so satisfied. We believe that mission should never change.”

Testimonials received in response to Johnson Brunetti survey conducted in 2024. Please click here for a description of the survey and the overall results.

-

John L.John L. is a client of Johnson Brunetti and received no compensation for his statement.

“We are extremely please with J&B. Referring back to our one word, Family, we trust your firm, advisors, and services as we would a member of the Family. Thank you for everything!”

Testimonials received in response to Johnson Brunetti survey conducted in 2024. Please click here for a description of the survey and the overall results.

-

Joe D.Joe D. is a client of Johnson Brunetti and received no compensation for his statement.

“Your model is working well, continue to keep your focus on your clients. The podcasts are an effective way of communicating information and real life stories. Your business is supporting your clients’ many different real life stories.”

Testimonials received in response to Johnson Brunetti survey conducted in 2024. Please click here for a description of the survey and the overall results.

-

Jackie L.Jackie L. is a client of Johnson Brunetti and received no compensation for her statement.

“I love how everyone in the company makes us feel. Like we are one big happy family. I wouldn’t change anything! “

Testimonials received in response to Johnson Brunetti survey conducted in 2024. Please click here for a description of the survey and the overall results.

-

Christine Q.Christine Q. is a client of Johnson Brunetti and received no compensation for her statement.

“Your services are exemplary and greatly appreciated by my husband and myself to live out our retirement years feeling safe and secure. Thank you!”

Testimonials received in response to Johnson Brunetti survey conducted in 2024. Please click here for a description of the survey and the overall results.

-

Barbara S.Barbara S. is a client of Johnson Brunetti and received no compensation for her statement.

“We are very happy with Johnson Brunetti. It has really taken a load off our shoulders. Thank you.”

Testimonials received in response to Johnson Brunetti survey conducted in 2024. Please click here for a description of the survey and the overall results.