7 Ways to Throw the Best Retirement Party

At Johnson Brunetti, we spend a lot of time talking about the financial side of retirement. Today, we are going to break up the monotony with a little bit of fun! Retirement is a rite of passage towards the next chapter of our lives. Consequently, it can be bittersweet. Some people are sad to say goodbye to their favorite colleagues. Others are excited to relocate to a warmer climate, or closer to family. Whether you’re getting ready for retirement, or if it’s for someone in your family, company or circle of friends, a retirement party is a special way to celebrate. We have a few suggestions for retirement party ideas to make it memorable, without breaking the bank.

Please keep in mind that these are only suggestions to help you throw a great party! This article is not a paid advertisement and none of the mentioned businesses are affiliated with JB Capital, LLC in any way. We encourage you to exercise all necessary safety and security precautions.

1. Create the Retirement Party Guest List

Consider any current colleagues, close family members, and friends. If it’s not a surprise party, it might be a good idea to talk to the honoree, therefore ensuring that all their closest colleagues are invited. This will help remove the guesswork. Keep in mind that this event can be a team effort. Don’t shy away from asking for help from a few different colleagues and friends who may be able to help you divide and conquer.

2. Research Venues

Once the guest list is created, it’s time to select a date and venue that suits your party size. Remember to be considerate when choosing a date. Weeknights can make it difficult for some people to attend. Likewise, try not to host the party during a holiday weekend when people might be traveling to be with family.

If the office is not an option, there are several creative options for venues besides a restaurant or banquet hall. You can host a backyard barbecue or pool party. You can also spend some time searching for unique and affordable venues in your town or state on websites like this. Bonus points if you’re able to tie the venue into the party’s theme!

3. Choose an Appropriate Theme for the Retirement Party

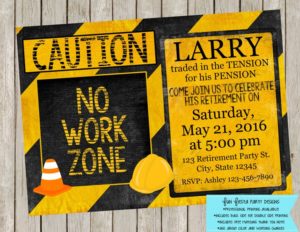

The most original themes help tell a story of the honoree – covering everything from their past, present, and future. For example, if the guest of honor worked in construction, you may want to incorporate hammers and hardhats. You can also use a favorite sports team or hobby as a theme. On the other hand, if they have a trip to Hawaii on the horizon, go for a luau theme. There are lots of ways to tie it into their personal life and make the details of the party special. Don’t be afraid to think outside of the box!

4. Make the Invitations

When the guest list, venue, and theme are all set, it’s time to work on invitations! If you’re looking to order something that you can customize yourself, start your research here. If you prefer something a little less do-it-yourself (DIY) that can still match your theme, try looking here. Be sure to address the invitation to your guests and inform them of whether or not they can bring a spouse or significant other. This article should help you communicate the most important event details.

5. Browse Personalized Gifts, Party Favors, and Decorations

If you aren’t opposed to shopping online, Etsy can be a fantastic resource to anyone looking to plan a party. You can find just about anything to fit your theme. Most importantly, many items can be personalized. From hats and funny t-shirts to engraved wooden signs, to these adorable retire-mints, and other creative party favors and accessories. In other words, there’s something for nearly every budget.

Please keep in mind, as with any online shopping, it’s important to be your own advocate. On Etsy, it’s really important and helpful to read the descriptions, shipping options and review all the photos. Keep in mind that each seller will have different store ratings, turnaround times, pricing and terms for doing business – make sure they are highly rated and come with positive transaction reviews.

Don’t go it alone if you’re not comfortable! Chances are, you have a friend or family member who has used Etsy before and can help you.

6. Consider Do-it-Yourself (DIY) Options

For those of you who love a good DIY project, Pinterest has great ideas for budget-friendly and inventive retirement party decorations, games

7. Make it Sweet

Sweeten the deal with a creative dessert that goes with the theme. If it’s a bigger party, try cake pops or cupcakes. This will remove the hassle of having to cut and distribute dessert.

Be sure to ask someone to say a few words about the honoree before dessert. Maybe even consider collecting photos and videos from friends, family, and colleagues to create a slideshow. You can either use a projector set, or cast the slideshow from a laptop onto a TV screen at your venue.

… And Most of All, Have Fun!

The most important part of the party is enjoying it! Even if you go minimal on the decorations and flair, it’s all about honoring the new retiree and making sure they have a great time.

Information presented in our podcasts is considered current as of the created date. Over time, some information presented may become stale. We recommend you consult with your Financial Professional before making any changes based on information contained here.

Johnson Brunetti is a marketing name for the businesses of JB Capital and JN Financial.

Investment Advisory Services offered through JB Capital, LLC. Insurance Products offered through JN Financial, LLC.

The guarantees provided by any type of insurance contract are based on the claims-paying ability of the insurance company.

Related Resources

-

Preparing for RMDs

Regardless of where you are in your retirement planning journey, required minimum distributions (RMDs) are a key factor to keep in mind. Gaining clarity on RMDs now can help you make more informed… -

Tariffs and Your Retirement

With growing concerns about rising tariffs and ongoing trade disputes, you may be wondering how these policy shifts could impact your retirement. While the situation around tariffs has stabilized … -

Can I Still Retire Comfortably If I’m Behind on Saving?

You’ve worked hard to reach retirement, and you deserve to enjoy it comfortably. But what if you discover you’re behind on your savings goal? In this week’s Money Wisdom Question Series, Nichol… -

Podcast Episode 411: What Happens to My Money After I Die?

Prefer to watch? Click here to watch and listen on YouTube. No one wants to think about life after they’re gone, but ignoring what happens to your money can leave your loved ones confused and v… -

What’s the Best Age to Start Taking RMDs?

Is it better to take your required minimum distribution (RMD) sooner rather than later? While the IRS determines when you must begin taking RMDs, you may benefit from taking them earlier. An RM… -

Should I Downsize My Home for Retirement?

Equity is on the minds of many pre-retirees and retirees today, more specifically: Should I downsize my home in retirement? And if so, when is the right time to do it? In this week’s Money Wisd… -

Podcast Episode 410: 2 Key Questions to Ask a Retirement Planner

Prefer to watch? Click here to watch and listen on YouTube. Meeting with a financial planner often sparks some of the most important questions. When it comes to retirement, there’s a lot to con… -

How Can You Protect Your Retirement Assets for Your Family?

When you’re focused on planning for retirement, it’s easy to overlook how you can protect your assets for both yourself and your family. While there’s no one-size-fits-all approach, your first ste… -

Podcast Episode 409: Which Retirement Accounts Should I Withdraw from First?

Prefer to watch? Click here to watch and listen on YouTube. Planning for retirement doesn’t end when you stop working. In fact, one of the most important financial decisions you’ll face in reti… -

How to Jumpstart Your Retirement Planning

Retirement planning can feel overwhelming, especially after decades of hard work and diligent saving. With so much to consider, how can you ensure your money lasts as long as you do? The good news…