Episode 84: How Can I Prepare for IRS Changes in 2023?

Have your question answered on the Money Wisdom Question Series!

Planning for IRS changes in 2023

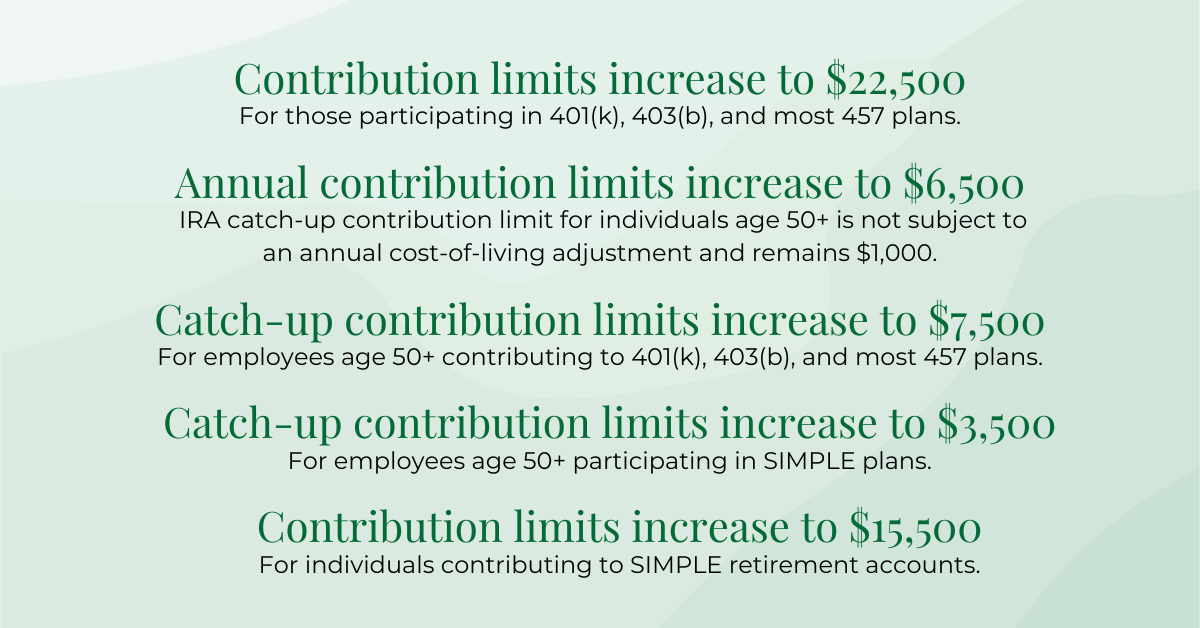

There are relevant and very important changes for those focusing on retirement planning to know. Due to inflation, the IRS has increased the contribution limits in retirement plans such as 401(K)s, 403(B)s, 457s, and some others, from $20,500 to $22,500 for everyone. If you’re over 50, they’ve increased it from $6,500 to $7,500. If you are over 50 and have the income, you can set aside as much as $30,000 tax-free into your 401(k) plan. That’s a big advantage that inflation has given us with the IRS tax code changes.

Adjusted Tax Brackets

Another change is adjusted brackets. The tax rates haven’t changed, but the brackets have broadened. Visually, you can imagine the buckets that hold certain amounts of money have gotten bigger. So, we all paid the same taxes on the same amounts of money as we go up through the income scale. Everybody pays 10 – 12% on the same amounts of money. The IRS has made those buckets about 7% larger.

In essence, all of us in 2023 will end up paying less taxes on our money. That doesn’t mean tax rates have changed. It means the brackets have gotten a little bit bigger, holding a little bit more money, which lowers our tax bill. If you’re saving into a retirement plan at work and you’re not able to meet the maximum amount of contribution limits, even making a small change that fits your goal and your desired retirement plan may push you into a lower tax bracket with how 401(k) deductions work on your W-2. That is a huge advantage someone can take to maximize their retirement plan and to minimize their taxes. It’s always a win-win when you get to pay less taxes and have more fun in retirement, which really is the goal.

If You’re Already Retired

For those that are already in retirement and are past the saving cycle, be aware that larger tax brackets can allow us to plan for an event, or something expensive, coming up in a few years. Taking the money out to keep ourselves at a lower tax bracket is one way we can maximize tax efficiency in our retirement plan because of these changes.

Roth Conversions

Another exciting way we can maximize tax efficiency is by doing Roth conversions for future planning. This gives us a little more room in the bucket to keep a lower tax rate on the amount that we convert into a Roth. Those are just a couple of ways that the tax changes in 2023 can impact us.

Find A Financial Professional

I just want to encourage you, if you don’t have a financial planner, to find one. It makes all the difference in retirement. Some retirement rules, like these IRS rules, can seem simple on their own, however, keep in mind the two we touched on, and how they interconnect and interrelate to one another is what makes them much more complex. Every person’s plan is different and unique to them. Figuring out how to take all these moving parts and put them together so that they work for you ensures that you can have your best retirement.

Information presented here is considered current as of the created date. Over time, some information presented may become stale. We recommend you consult with your Financial Professional before making any changes based on information contained here.

Johnson Brunetti is a marketing name for the businesses of JB Capital and JN Financial.

Investment Advisory Services offered through JB Capital, LLC. Insurance Products offered through JN Financial, LLC.

The guarantees provided by any type of insurance contract are based on the claims-paying ability of the insurance company.

Related Resources

-

How Can I Supplement My Medicare Coverage?

Original Medicare (Parts A and B) can cover a lot, from hospital stays to doctor visits and outpatient care. But it doesn’t cover everything. Most prescription drugs, dental care, vision, and hear… -

Podcast Episode 438: What 59% of Retirees Wish They’d Known About Taxes

Prefer to watch? Click here to watch and listen on YouTube. According to a recent Nationwide Retirement Institute survey, 59% of retirees regret not preparing for taxes. More specifically, how … -

Should I Use AI for Investing Advice?

Artificial intelligence (AI) has become ingrained in many aspects of our lives, including our financial lives. About two-thirds of Americans are already turning to generative AI for financial advi… -

What is the Financial Impact of Retiring at 62 vs 65?

Retiring at any age requires thoughtful, tailored planning. But when faced with the choice to take an early retirement or continue working, the right answer depends on several personal factors. … -

What’s the Biggest Challenge Retirees Will Face?

Over the next decade, retirees will face many challenges, but the biggest one may not be financial. While markets, inflation, healthcare, and taxes are all important, Joel Johnson, CFP® highlights… -

How Is Medicare Changing in 2026?

Medicare costs like premiums, deductibles, and copays generally change every year. But what does this mean for your broader retirement plan? Well, even small adjustments can have a large impa… -

What Financial Resolutions Should I Make This Year?

What financial resolutions will you ring in the new year with? According to Vanguard’s new consumer survey, most Americans feel confident in achieving their 2026 financial resolutions. While that’… -

What Important Financial Wisdom Have You Learned?

Your behavior around money can either be your greatest obstacle or your greatest strength. Often, an investor’s behavior is the biggest impediment to their success. With over 30 years of experi… -

What Should I Do If I’m Laid Off Right Before Retirement?

A layoff close to retirement can rock your sense of financial stability, but it doesn’t have to derail your plans. Job losses often lead many people to take an earlier-than-expected retirement. Bu… -

Should I Retire in 2026?

Deciding to retire at any time depends more on your personal financial readiness than on the calendar year itself. But while there is no one-size-fits-all answer, there are certain indicators to t…

-

Laura H.Laura H. is a client of Johnson Brunetti and received no compensation for their statement.

“Your corporate values and mission have stayed constant which we’d say is the primary reason we are so satisfied. We believe that mission should never change.”

Testimonials received in response to Johnson Brunetti survey conducted in 2024. Please click here for a description of the survey and the overall results.

-

John L.John L. is a client of Johnson Brunetti and received no compensation for his statement.

“We are extremely please with J&B. Referring back to our one word, Family, we trust your firm, advisors, and services as we would a member of the Family. Thank you for everything!”

Testimonials received in response to Johnson Brunetti survey conducted in 2024. Please click here for a description of the survey and the overall results.

-

Joe D.Joe D. is a client of Johnson Brunetti and received no compensation for his statement.

“Your model is working well, continue to keep your focus on your clients. The podcasts are an effective way of communicating information and real life stories. Your business is supporting your clients’ many different real life stories.”

Testimonials received in response to Johnson Brunetti survey conducted in 2024. Please click here for a description of the survey and the overall results.

-

Jackie L.Jackie L. is a client of Johnson Brunetti and received no compensation for her statement.

“I love how everyone in the company makes us feel. Like we are one big happy family. I wouldn’t change anything! “

Testimonials received in response to Johnson Brunetti survey conducted in 2024. Please click here for a description of the survey and the overall results.

-

Christine Q.Christine Q. is a client of Johnson Brunetti and received no compensation for her statement.

“Your services are exemplary and greatly appreciated by my husband and myself to live out our retirement years feeling safe and secure. Thank you!”

Testimonials received in response to Johnson Brunetti survey conducted in 2024. Please click here for a description of the survey and the overall results.

-

Barbara S.Barbara S. is a client of Johnson Brunetti and received no compensation for her statement.

“We are very happy with Johnson Brunetti. It has really taken a load off our shoulders. Thank you.”

Testimonials received in response to Johnson Brunetti survey conducted in 2024. Please click here for a description of the survey and the overall results.