Episode 84: How Can I Prepare for IRS Changes in 2023?

Have your question answered on the Money Wisdom Question Series!

Planning for IRS changes in 2023

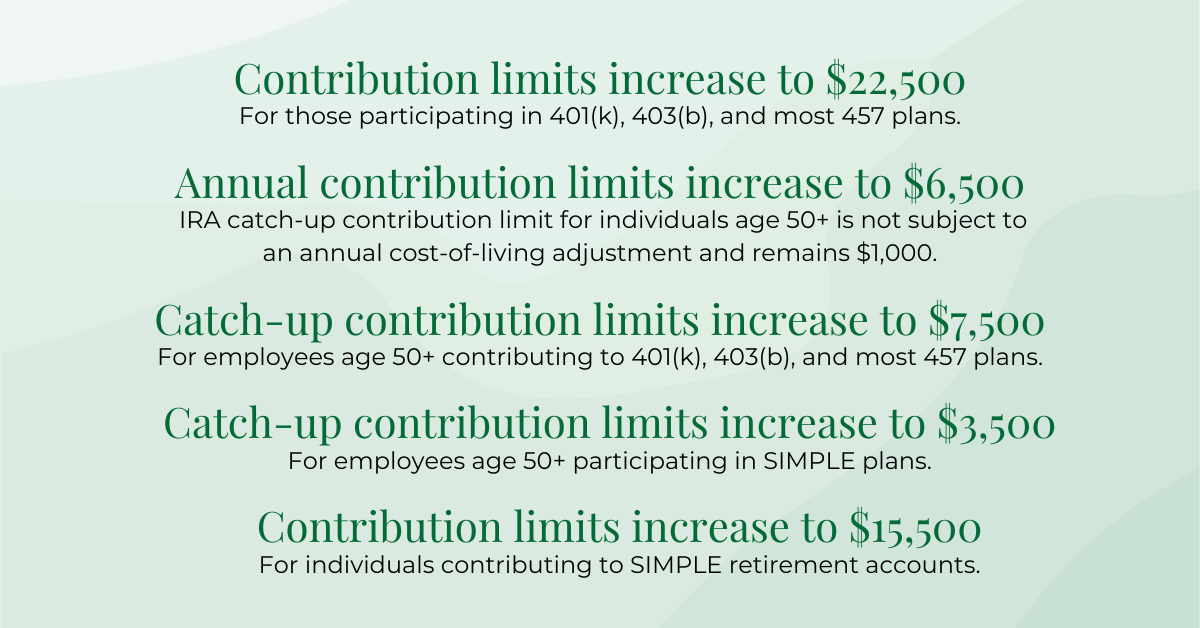

There are relevant and very important changes for those focusing on retirement planning to know. Due to inflation, the IRS has increased the contribution limits in retirement plans such as 401(K)s, 403(B)s, 457s, and some others, from $20,500 to $22,500 for everyone. If you’re over 50, they’ve increased it from $6,500 to $7,500. If you are over 50 and have the income, you can set aside as much as $30,000 tax-free into your 401(k) plan. That’s a big advantage that inflation has given us with the IRS tax code changes.

Adjusted Tax Brackets

Another change is adjusted brackets. The tax rates haven’t changed, but the brackets have broadened. Visually, you can imagine the buckets that hold certain amounts of money have gotten bigger. So, we all paid the same taxes on the same amounts of money as we go up through the income scale. Everybody pays 10 – 12% on the same amounts of money. The IRS has made those buckets about 7% larger.

In essence, all of us in 2023 will end up paying less taxes on our money. That doesn’t mean tax rates have changed. It means the brackets have gotten a little bit bigger, holding a little bit more money, which lowers our tax bill. If you’re saving into a retirement plan at work and you’re not able to meet the maximum amount of contribution limits, even making a small change that fits your goal and your desired retirement plan may push you into a lower tax bracket with how 401(k) deductions work on your W-2. That is a huge advantage someone can take to maximize their retirement plan and to minimize their taxes. It’s always a win-win when you get to pay less taxes and have more fun in retirement, which really is the goal.

If You’re Already Retired

For those that are already in retirement and are past the saving cycle, be aware that larger tax brackets can allow us to plan for an event, or something expensive, coming up in a few years. Taking the money out to keep ourselves at a lower tax bracket is one way we can maximize tax efficiency in our retirement plan because of these changes.

Roth Conversions

Another exciting way we can maximize tax efficiency is by doing Roth conversions for future planning. This gives us a little more room in the bucket to keep a lower tax rate on the amount that we convert into a Roth. Those are just a couple of ways that the tax changes in 2023 can impact us.

Find A Financial Professional

I just want to encourage you, if you don’t have a financial planner, to find one. It makes all the difference in retirement. Some retirement rules, like these IRS rules, can seem simple on their own, however, keep in mind the two we touched on, and how they interconnect and interrelate to one another is what makes them much more complex. Every person’s plan is different and unique to them. Figuring out how to take all these moving parts and put them together so that they work for you ensures that you can have your best retirement.

Information presented in our podcasts is considered current as of the created date. Over time, some information presented may become stale. We recommend you consult with your Financial Professional before making any changes based on information contained here.

Johnson Brunetti is a marketing name for the businesses of JB Capital and JN Financial.

Investment Advisory Services offered through JB Capital, LLC. Insurance Products offered through JN Financial, LLC.

The guarantees provided by any type of insurance contract are based on the claims-paying ability of the insurance company.

Related Resources

-

Podcast Episode 414: What Does the Big Beautiful Bill Really Mean for Your Retirement?

There’s been a lot of noise around the One Big Beautiful Bill Act (OBBBA), an 887-page piece of legislation that just reshaped key elements of the tax code. But what does it actually mean for your… -

How Does the Big Beautiful Bill Affect Me?

On July 4, 2025, the One Big Beautiful Bill Act (OBBBA) was signed into law, bringing significant changes to the U.S. tax code. But what does it mean for you? What actions should you consider? And… -

What’s the Right Medicare Plan for Me?

There is a lot to consider when choosing the right Medicare plan: How often do you visit the doctor? Do you have any chronic conditions? Do you take prescription drugs regularly? Answering these q… -

What Happens to My Retirement Accounts When I Pass Away?

What happens to your retirement accounts after you die depends largely on your personal situation and legacy planning goals. Are you single or married? Do you have children? Do you want to leave m… -

Preparing for RMDs

Regardless of where you are in your retirement planning journey, required minimum distributions (RMDs) are a key factor to keep in mind. Gaining clarity on RMDs now can help you make more informed… -

Staying Ahead of the Tax Curve

Retirement doesn’t mean you stop paying taxes – but there are ways to minimize the bite in the long run. With thoughtful, proactive tax planning, you can stay ahead of the curve and keep more of w… -

Can I Still Retire Comfortably If I’m Behind on Saving?

You’ve worked hard to reach retirement, and you deserve to enjoy it comfortably. But what if you discover you’re behind on your savings goal? In this week’s Money Wisdom Question Series, Nichol… -

What’s the Best Age to Start Taking RMDs?

Is it better to take your required minimum distribution (RMD) sooner rather than later? While the IRS determines when you must begin taking RMDs, you may benefit from taking them earlier. An RM… -

Should I Downsize My Home for Retirement?

Equity is on the minds of many pre-retirees and retirees today, more specifically: Should I downsize my home in retirement? And if so, when is the right time to do it? In this week’s Money Wisd… -

How Can You Protect Your Retirement Assets for Your Family?

When you’re focused on planning for retirement, it’s easy to overlook how you can protect your assets for both yourself and your family. While there’s no one-size-fits-all approach, your first ste…