Episode 2: What Will Market Recovery Look Like?

Have your question answered on the Money Wisdom Question Series!

Thank you for joining me for Episode 2 of my NEW Money Wisdom Question Series, where I film answers to common financial and retirement investment questions in 2 minutes or less. Today we’re going to talk about some of the possible ways the market may recover from the pandemic.

Is our economy going to come back quickly? Is it going to take a long time? Some people are even asking, are we going into a depression? Obviously, we’re going into a recession, but maybe a depression, some say.

It’s very unnerving, right? If you have, 401(k)s, or you have retirement money and you don’t necessarily want to know what to do. And, keep in mind, the stock market is a leading indicator of what’s happening in the future, which is why a lot of people don’t understand why the stock market can be doing OK, when the economy seems like it’s having a hard time.

Three Different Types of Market Recoveries

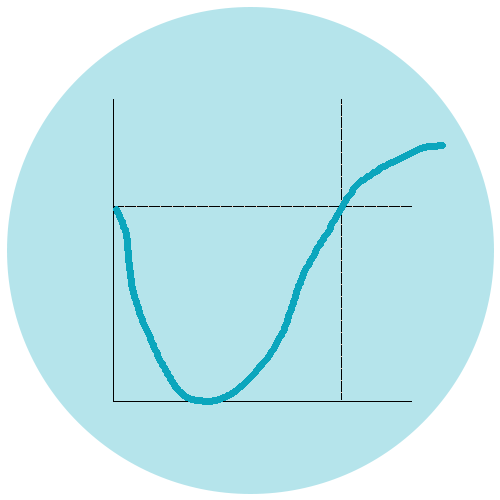

- U-Shaped Recovery

- The economy goes into a downturn gradually and it comes back up out of that downturn gradually.

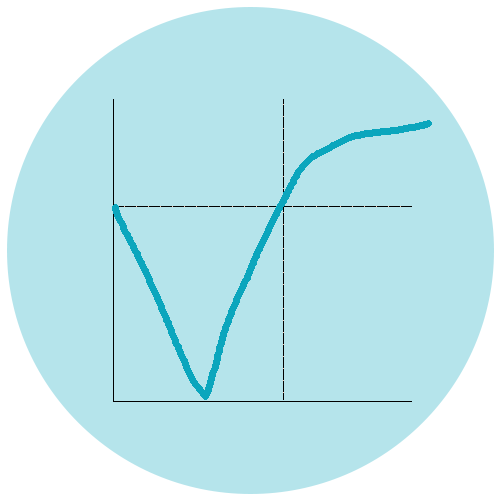

- V-Shaped Recovery

- The economy goes into a downturn very quickly and comes back up very quickly.

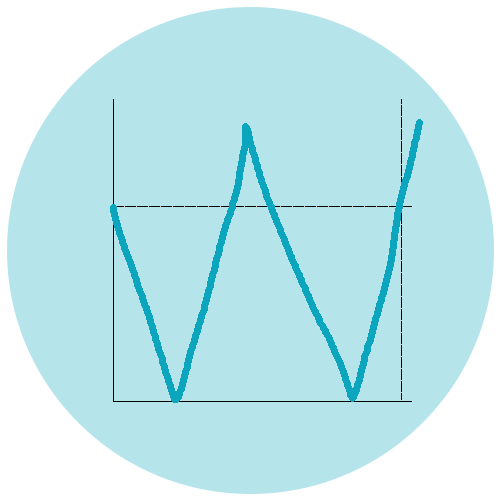

- W-Shaped Recovery

- The economy goes into a downturn, it starts bouncing back, and then it goes downwards again.

The question is, which one of these are we going to have after the pandemic? And you know what? It doesn’t matter, because you need to have a financial plan that does not depend on the stock market for your success.

Once again, we don’t know what the recovery is going to be like. My gut says it might take a while for us to get back to the way we were in early 2020, but I could be wrong. No economists really know, but we are probably

in for a rough ride and you need to make sure you’re doing everything you can to have a good retirement plan in place.

Thanks for joining me and I hope you found this information helpful!

P.S. If you enjoyed this topic and you want to hear more, you’ll love this podcast episode I recorded where I talk about the very same subject, in more detail.

P.P.S. Feel free to submit questions here for a chance to have them answered!

Download Now

Are You Ready To Retire?

Get information and education that can bring you peace of mind with your savings and retirement.

Information presented here is considered current as of the created date. Over time, some information presented may become stale. We recommend you consult with your Financial Professional before making any changes based on information contained here.

Johnson Brunetti is a marketing name for the businesses of JB Capital and JN Financial.

Investment Advisory Services offered through JB Capital, LLC. Insurance Products offered through JN Financial, LLC.

The guarantees provided by any type of insurance contract are based on the claims-paying ability of the insurance company.

Related Resources

-

What is the Financial Impact of Retiring at 62 vs 65?

Retiring at any age requires thoughtful, tailored planning. But when faced with the choice to take an early retirement or continue working, the right answer depends on several personal factors. … -

What’s the Biggest Challenge Retirees Will Face?

Over the next decade, retirees will face many challenges, but the biggest one may not be financial. While markets, inflation, healthcare, and taxes are all important, Joel Johnson, CFP® highlights… -

Podcast Episode 435: 6 Steps to Financial Fitness in 2026

Prefer to watch? Click here to watch and listen on YouTube. Every January, getting in shape tops the list of the most common New Year’s resolutions. But what about improving your financial fitn… -

How Is Medicare Changing in 2026?

Medicare costs like premiums, deductibles, and copays generally change every year. But what does this mean for your broader retirement plan? Well, even small adjustments can have a large impa… -

Podcast Episode 434: I’m 59½, What Should I Do with My 401(k)?

Prefer to watch? Click here to watch and listen. If you’re approaching age 59½, you’ve hit an important financial milestone. New options are now available, and you may not realize just how many… -

What Financial Resolutions Should I Make This Year?

What financial resolutions will you ring in the new year with? According to Vanguard’s new consumer survey, most Americans feel confident in achieving their 2026 financial resolutions. While that’… -

What Important Financial Wisdom Have You Learned?

Your behavior around money can either be your greatest obstacle or your greatest strength. Often, an investor’s behavior is the biggest impediment to their success. With over 30 years of experi… -

What Should I Do If I’m Laid Off Right Before Retirement?

A layoff close to retirement can rock your sense of financial stability, but it doesn’t have to derail your plans. Job losses often lead many people to take an earlier-than-expected retirement. Bu… -

Podcast Episode 431: Am I Holding Too Much Cash in Retirement?

Prefer to watch? Click here to watch and listen on YouTube. What does it mean to be financially “safe” once you retire and your paycheck stops? If you’re wondering whether too much cash could p… -

Should I Retire in 2026?

Deciding to retire at any time depends more on your personal financial readiness than on the calendar year itself. But while there is no one-size-fits-all answer, there are certain indicators to t…

-

Laura H.Laura H. is a client of Johnson Brunetti and received no compensation for their statement.

“Your corporate values and mission have stayed constant which we’d say is the primary reason we are so satisfied. We believe that mission should never change.”

Testimonials received in response to Johnson Brunetti survey conducted in 2024. Please click here for a description of the survey and the overall results.

-

John L.John L. is a client of Johnson Brunetti and received no compensation for his statement.

“We are extremely please with J&B. Referring back to our one word, Family, we trust your firm, advisors, and services as we would a member of the Family. Thank you for everything!”

Testimonials received in response to Johnson Brunetti survey conducted in 2024. Please click here for a description of the survey and the overall results.

-

Joe D.Joe D. is a client of Johnson Brunetti and received no compensation for his statement.

“Your model is working well, continue to keep your focus on your clients. The podcasts are an effective way of communicating information and real life stories. Your business is supporting your clients’ many different real life stories.”

Testimonials received in response to Johnson Brunetti survey conducted in 2024. Please click here for a description of the survey and the overall results.

-

Jackie L.Jackie L. is a client of Johnson Brunetti and received no compensation for her statement.

“I love how everyone in the company makes us feel. Like we are one big happy family. I wouldn’t change anything! “

Testimonials received in response to Johnson Brunetti survey conducted in 2024. Please click here for a description of the survey and the overall results.

-

Christine Q.Christine Q. is a client of Johnson Brunetti and received no compensation for her statement.

“Your services are exemplary and greatly appreciated by my husband and myself to live out our retirement years feeling safe and secure. Thank you!”

Testimonials received in response to Johnson Brunetti survey conducted in 2024. Please click here for a description of the survey and the overall results.

-

Barbara S.Barbara S. is a client of Johnson Brunetti and received no compensation for her statement.

“We are very happy with Johnson Brunetti. It has really taken a load off our shoulders. Thank you.”

Testimonials received in response to Johnson Brunetti survey conducted in 2024. Please click here for a description of the survey and the overall results.